Technical Analysis Post

Analyzing TSMC's Q1 2024: Market Dynamics, Dividend Performance, and Earnings Forecast

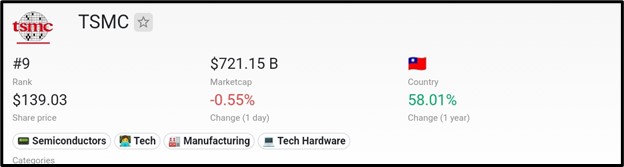

The Quiet Period for Taiwan Semiconductor Manufacturing Company, Limited (NYSE:TSM) ahead of its First Quarter 2024 Earnings Conference, scheduled for Thursday, April 18, 2024, at 14:00 Taiwan time/2:00 Eastern Time, is from April 11 to 17, 2024. During this time, TSMC refrains from engaging with investment communities. As of April 2024, TSMC boasts a market cap of $721.15 billion, positioning it as the world’s 9th most valuable company by market capitialisation.

TSMC Dividend Information

TSMC offers an annual dividend of $1.76 per share, providing a forward yield of 1.27%. This dividend is distributed quarterly, with the next ex-dividend date set for June 13, 2024. The company’s dividend yield stands at 1.27%, with a payout ratio of 35.33%. Notably, TSMC has achieved a dividend growth rate of 8.07%. Despite a slight negative buyback yield of -0.01%, the shareholder yield remains positive at 1.26%.

Recent developments at TSMC

TSMC recently revealed a new venture in partnership with Japanese entities Sony Semiconductor, Denso Corporation, and Toyota Motor Corporation, aimed at investing in JASM and establishing a second fab set to commence operations by the close of 2027.

The Biden-Harris Administration unveiled preliminary terms with TSMC, marking an expanded investment from the company to introduce the world’s most advanced leading-edge technology to the U.S.

TSMC has resumed operations at construction sites following a temporary shutdown prompted by an earthquake.

Operations at Taiwan Semiconductor Manufacturing Co. were temporarily halted, with some chipmaking activities suspended and staff evacuated after a 7.4 magnitude earthquake struck Taiwan.

2023 Q4 Recap And 2024 Q1 Outlook

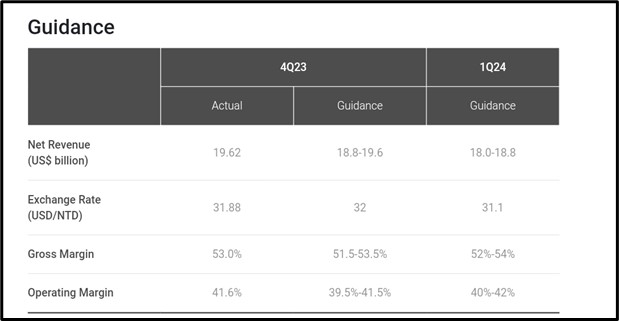

TSMC reported Q4 2023 revenue of NT$625.53 billion, net income of NT$238.71 billion, and diluted EPS of NT$9.21 (US$1.44 per ADR unit). Compared to Q3 2023, revenue increased by 14.4%, with a 13.1% rise in net income. However, both net income and diluted EPS decreased by 19.3% year-over-year. Q4 revenue in USD was $19.62 billion, down 1.5% YoY but up 13.6% from Q3. Gross margin was 53.0%, operating margin was 41.6%, and net profit margin was 38.2%. Shipments of 3-nanometer accounted for 15%, 5-nanometer for 35%, and 7-nanometer for 17% of total wafer revenue. Advanced technologies represented 67% of total wafer revenue.

Management expects Q1 2024 revenue between US$18.0 billion and US$18.8 billion, with gross profit margin between 52% and 54%, and operating profit margin between 40% and 42%. The 2024 capital budget is forecasted to be between US$28 billion and US$32 billion.

2024 Q1 Earnings Analyst Forecast

In the current quarter of 2024, Zacks Consensus Estimate predicts earnings per share (EPS) to be $1.29, with three estimates contributing to this forecast. The high estimate for EPS is $1.31, while the low estimate is $1.28. Comparatively, the year ago EPS was $1.31, indicating a year-over-year growth estimate of -1.53%.

For sales estimates in the same quarter, the Zacks Consensus Estimate stands at 18.388B, with a single estimate contributing to this forecast. The high and low estimates for sales are also 18.388B. In contrast, the year ago sales were 16.72B, reflecting a robust year-over-year growth estimate of 9.96%.

According to Investing.com, the anticipated earnings per share (EPS) for Taiwan Semiconductor Manufacturing Company, Limited (NYSE:TSM) is estimated to be $1.3, with an expected revenue of $18.28 billion.

As per tradingview.com, the estimated earnings per share (EPS) for Taiwan Semiconductor Manufacturing Company, Limited (NYSE:TSM) stands at $1.30, while the expected revenue is $18.31 billion.

Technical Analysis

From a technical analysis perspective, based on the 4-hour chart of Taiwan Semiconductor Manufacturing Company, Limited (NYSE:TSM) on tradingview, the price has been oscillating within a range. Currently, $148.47 acts as a resistance level, while $137.06 serves as a support level since April 1st, 2024, with the current price hovering around $139.03.

If the support level is breached downward, there is a high probability of further price decline. Conversely, if the support level holds, there is a strong likelihood of the price rising towards the resistance level. Furthermore, if the resistance level is breached upward, there is a high probability of further price appreciation.

Conclusion

In conclusion, as Taiwan Semiconductor Manufacturing Company, Limited (TSMC) prepares for its First Quarter 2024 Earnings Conference, the company’s solid market position, demonstrated by its impressive market cap and dividend performance, sets a promising backdrop. Despite the challenges posed by fluctuating earnings forecasts and technical analysis projections, TSMC’s steadfast commitment to innovation and strategic planning underscores its resilience in navigating market dynamics. As investors await the unveiling of its quarterly results, the company’s track record of delivering strong performance amid evolving industry landscapes instills confidence in its ability to sustain long-term growth and value creation.

Sources :

https://companiesmarketcap.com/tsmc/marketcap/

https://investor.tsmc.com/english/quarterly-results/2024/q1

https://stockanalysis.com/stocks/tsm/dividend/

https://investor.tsmc.com/english/quarterly-results/2023/q4

https://www.zacks.com/stock/quote/TSM/detailed-earning-estimates

https://www.investing.com/equities/taiwan-semicond.manufacturing-co-earnings

https://www.tradingview.com/symbols/NYSE-TSM/forecast/

https://www.tradingview.com/x/s8XEJoMB/

https://qz.com/taiwan-deadly-earthquake-stopped-chipmaking-tsmc-1851383953