Technical Analysis Post

Citigroup Inc. (NYSE: C) Q1 Earnings: Anticipation, Analysis, and Technical Insights

Citigroup Inc. (NYSE: C) is gearing up to unveil its Q1 earnings on April 12, 2024. Amidst the recent excitement surrounding Citigroup, investors are eyeing potential gains from its dividends.

Citigroup Inc. (NYSE: C) is gearing up to unveil its Q1 earnings on April 12, 2024. Amidst the recent excitement surrounding Citigroup, investors are eyeing potential gains from its dividends.

Currently, Citigroup offers an annual dividend yield of 3.44%, equating to a quarterly dividend of $0.53 per share ($2.12 annually). The banking and financial services sector appears robust from a credit perspective, with positive trends observed in credit card vintages among major players.

Currently, Citigroup offers an annual dividend yield of 3.44%, equating to a quarterly dividend of $0.53 per share ($2.12 annually). The banking and financial services sector appears robust from a credit perspective, with positive trends observed in credit card vintages among major players.

2023 Q4 Recap and 2024 Q1 Earnings Drivers:

In the last reported quarter, Citigroup’s earnings fell short of expectations, reporting ($1.16) earnings per share, missing estimates by $1.89. Quarterly revenue stood at $17.44 billion, down 3.1% year-over-year. Despite this, Citigroup anticipates a notable earnings growth of 23.58% in the coming year. Looking ahead to Q1 2024, several factors are poised to influence Citigroup’s performance.

Factors Influencing 2024 Q1 Results:

Loans & NII: The stabilizing macroeconomic environment may bolster lending activities, although steady interest rates and high funding costs might dampen net interest income (NII). The Zacks Consensus Estimate for NII is $13.64 billion, projecting a 1.4% decrease from the prior quarter.

Fee Income: A rebound in global mergers and acquisitions is anticipated to drive fee income, with management expecting improvement in investment banking fees. However, volatility in equity markets and other asset classes may impact year-over-year performance.

Expenses: Management’s focus on technology revamping and internal controls could inflate expenses. Non-interest expenses are estimated at $14.29 billion for the first quarter, reflecting a 7.5% rise year-over-year.

Key Developments During 2024 Q1 :

In late March, Citigroup announced significant actions aimed at simplifying its operating structure and enhancing performance. These initiatives align with the company’s long-term vision of becoming a leading banking partner globally. However, prior to the earnings release, downward revisions in earnings estimates indicate a cautious sentiment among analysts.

Analyst Forecast:

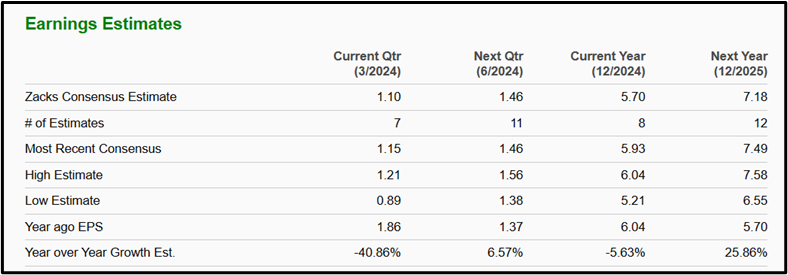

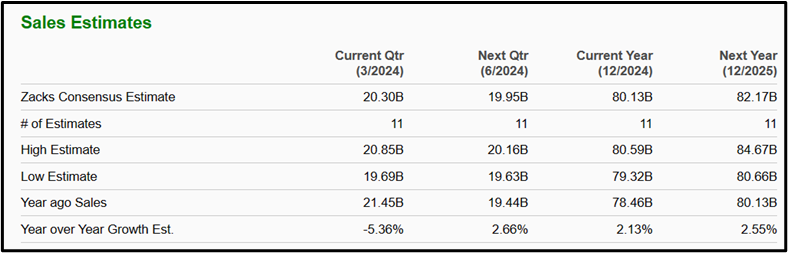

The Zacks Consensus Estimate for first-quarter earnings stands at $1.10, revised 3.9% lower over the past week, implying a 21.8% year-over-year decline. Additionally, revenue estimates of $20.3 billion suggest a 5.4% decline from the previous year’s reported level, reflecting bearish sentiment among analysts.

Investing.com anticipates that Citigroup Inc. (NYSE: C) will report earnings results for its first quarter, scheduled to be released before the opening bell on April 12, 2024, with an estimated EPS of $1.22 and expected revenue of $20 billion.

Investing.com anticipates that Citigroup Inc. (NYSE: C) will report earnings results for its first quarter, scheduled to be released before the opening bell on April 12, 2024, with an estimated EPS of $1.22 and expected revenue of $20 billion.

TradingView.com projects that Citigroup Inc. (NYSE: C) is expected to report earnings results for its first quarter, which are anticipated to be released before the opening bell on April 12, 2024. The forecast suggests an earnings per share (EPS) of $1.18 and revenue totaling $20.46 billion.

TradingView.com projects that Citigroup Inc. (NYSE: C) is expected to report earnings results for its first quarter, which are anticipated to be released before the opening bell on April 12, 2024. The forecast suggests an earnings per share (EPS) of $1.18 and revenue totaling $20.46 billion.

Technical Analysis

From a technical analysis perspective using the Daily Chart of Citigroup Inc. (NYSE: C) on TradingView, it’s evident that the stock price has been on an upward trend since February 13th, 2024.

An upward trendline originating from February 13th, 2024, at a price of $52.24, prevented the price from reversing downwards when it reached $56.48 on March 15th, 2024, following a retracement from $58.68. After this rejection, the price continued its upward trajectory, reaching $63.97 on April 1st, 2024, which now serves as the resistance level. Subsequently, the price retraced to the trendline, reaching $59.59 on April 10th, 2024, where it faced rejection again, with the price currently around $60.46.

If the current rejection by the upward trendline holds, there is a high probability of the price ascending further towards the resistance. However, if the rejection from the trendline fails, and the price breaks below it, there is a high likelihood of a reversal in the uptrend.

Furthermore, if the current rejection by the upward trendline holds, and the price reaches the resistance without facing rejection, and then proceeds to break above the trendline, there is a high probability of further upward movement in the price.

Conclusion

In conclusion, as Citigroup Inc. (NYSE: C) prepares to release its Q1 earnings on April 12, 2024, investors are closely monitoring its performance and dividend potential. Despite a challenging 2023 Q4, the company anticipates notable earnings growth in the coming year. Key factors such as lending activities, fee income, and expenses are poised to influence its Q1 2024 results. Additionally, recent initiatives aimed at streamlining operations align with its long-term vision. However, downward revisions in earnings estimates suggest cautious sentiment among analysts. With differing forecasts from Investing.com and TradingView.com, uncertainty remains regarding the exact earnings and revenue figures. From a technical standpoint, the stock has exhibited an upward trend, but the reaction at the resistance level will be crucial in determining its future trajectory.

Sources:

https://www.citigroup.com/global/news/press-release/2024/citi-first-quarter-2024-earnings-call

https://www.citigroup.com/rcs/citigpa/storage/public/2023prqtr4fn.pdf

https://www.zacks.com/stock/quote/C/detailed-earning-estimates

Citigroup (C) Earnings Dates & Reports – Investing.com

C Forecast — Price Target — Prediction for 2025 (tradingview.com)